OUR SERVICES

At AB Accounting Maclean we aim to provide you with advice when your business needs it, not just when you ask.

INTERNET LINKS

View our handy online tools and resources featuring the latest tax facts, key dates, & internet links.

WHY AB ACCOUNTING MACLEAN?

We appreciate that selecting a firm to entrust with your accounting, financial, and business advisory requirements is an important decision.

CONTACT US

Whatever your requirements, we will help you find the solutions, please feel free to browse our site and contact us for more information.

At AB Accounting Maclean we pride ourselves on giving good, sound advice in the areas of wealth creation, asset protection, and taxation matters.

Woolitji House, 203 River Street MACLEAN 2463

Opposite the Spar Supermarket

At AB Accounting Maclean we aim to expand the solid foundations on which we have built the firm through the creation of value and wealth for our clients. We pride ourselves on providing professional advice to our clients in the areas of Taxation, Asset Protection, Business advice, Business planning, Cash-flows, Budgeting, Succession planning and Superannuation.

For more information on how our expertise can benefit you, contact us today!

Liability limited by a scheme approved under Professional Standards Legislation.

Information we are required to disclose to you

As a Tax Agent, our work for you is performed in accordance with the Tax Agent Services Act 2009. Under this Act, the Tax Agent Services (Code of Professional Conduct) Determination 2024 requires that we make the following disclosures to you:

- Matters that could significantly influence your decision to engage us (or continue to engage us) for a Tax Agent Service from 1 July 2022 onward include the following:

- None Applicable

- The Tax Practitioner’s Board maintains a register of Tax Agents and BAS Agents. You can access and search this register here: https://www.tpb.gov.au/public-register

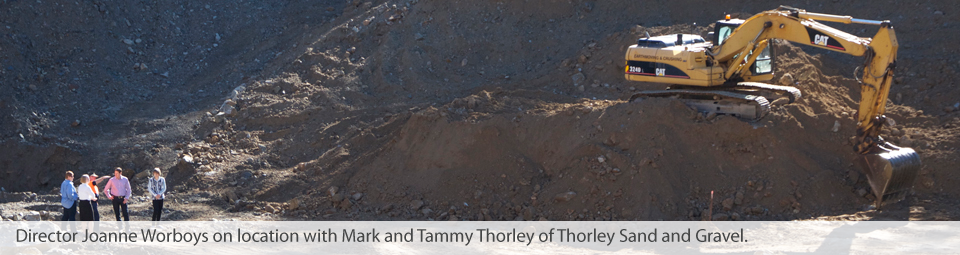

- If you have a complaint about our Tax Agent services, you will need to contact your Accountant in the first instance with details by email. If they are unable to resolve your complaint within 3 business days, please contact Joanne Worboys, Director by email at joannew@abaccounting.com.au. Your complaint will be investigated by the Director. We will provide you with email acknowledgement of receipt of your complaint and our understanding of the circumstances. The email will inform you that we will attempt to resolve your complaint within 14 days and will outline the dispute resolution process. If you are unhappy with the outcome that we propose to you, you can then make a complaint to the Tax Practitioners Board (TPB) using the link listed above. The TPB will send you an email to acknowledge the receipt of your complaint and review and risk assess your complaint. If you are unhappy with how the TPB has dealt with your complaint, the above link includes details about your review rights and who can further assist you